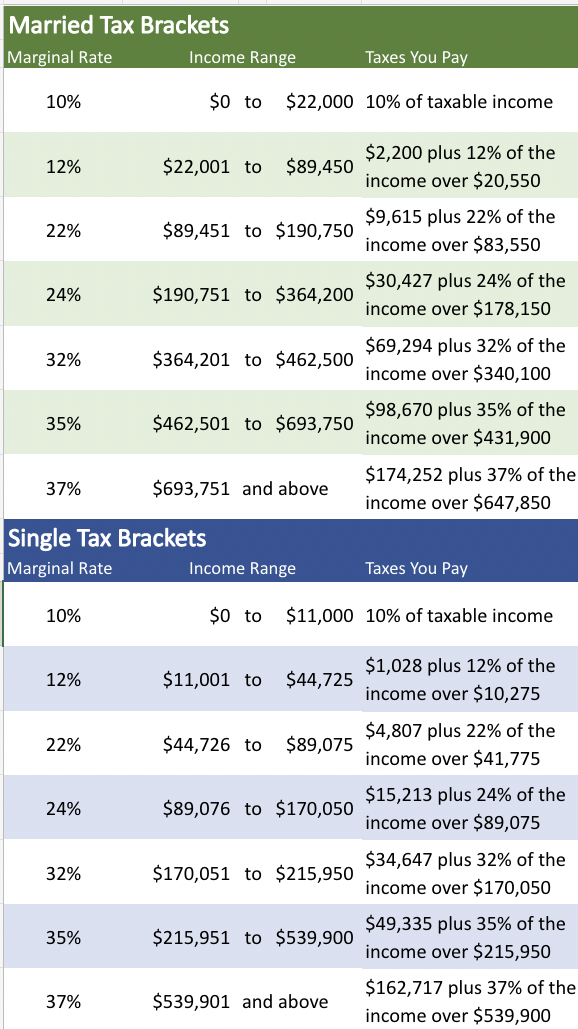

Mfj Tax Brackets 2025 - 2025 Tax Brackets Mfj Limits Brook Collete, New tax regime may see higher deduction limit. The federal income tax has seven tax rates in 2025: Here are the tax brackets for married filing jointly (mfj) for tax year 2025, to be filed in 2025.

2025 Tax Brackets Mfj Limits Brook Collete, New tax regime may see higher deduction limit. The federal income tax has seven tax rates in 2025:

Mfj Tax Bracket 2025 Neda Tandie, Important tax numbers for 2025. There are seven tax brackets for most ordinary income for the 2023 tax year:

2025 Tax Brackets Single Filer Nikki Analiese, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2025, including the tax rate schedules and other tax changes.

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Federal Tax Revenue Brackets For 2023 And 2025, Important tax numbers for 2025. Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2025, including the tax rate schedules and other tax changes.

Irs Gov Tax Table Matttroy, As of 2025, the amt exemption threshold for single filers or heads of household starts at $85,700 and begins to phase out at $609,350. Below are some highlights for your information and tax planning this year.

Mfj Tax Brackets 2025. 2025 tax brackets mfj limits brook collete, as your income goes up, the tax rate on the next. There are seven (7) tax rates in 2025.

2025 Tax Brackets Mfj Vilma Jerrylee, There are seven tax brackets for most ordinary income for the 2023 tax year: There are seven (7) tax rates in 2025.

Ca State Tax Rates 2023 PELAJARAN, Your bracket depends on your taxable income and filing status. As of 2025, the amt exemption threshold for single filers or heads of household starts at $85,700 and begins to phase out at $609,350.

The seven federal income tax brackets for 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Tax Brackets 2025 California Nerti Yoshiko, Here are the tax brackets for married filing jointly (mfj) for tax year 2025, to be filed in 2025. The first $11,600 of income will be taxed at 10%;